10 Years or Forever? (July 2023)

While building a single business for the rest of your life is not for most people, nothing gives me more excitement than meeting founders who believe and act this way. A few observable behaviors:

- Always ultra-sensitive to dilution

- Careful with who gets added to the board

- Never go for broke

In the history of great companies, they always take time. 10 years sounds like a lot, but it is just the beginning phase. Most of the dominance work and absolute value creation will kick in during the 2nd and 3rd decade of a company’s existence.

I fully understand how hard is to be excited about the same thing for a long long time. But my view is that those who think they are just getting started at the 10th anniversary of a company are the ones I want to bet on.

It’s a long journey. That’s why one needs to pick an idea that speaks to them given one’s own background.

___________________________________________________________________________

Unintended Consequences (July 2023)

The delayed rate cut in Brazil will ultimately help the perception of the current gov’t when it needs the most: the next Presidential re-election cycle.

It’s well understood that changes to monetary policy have 6 to 12 months delay to impact the real economy.

That means a potential tough 2024 for Brazilian GDP, but with the upcoming rate cut cycle the country is about to embark on GDP growth in 2025/26 will be strong.

Ultimately, the conservative stance now will help the current government the most when they most care about GDP growth.

In the meantime, terms of trade are looking fantastic. Stronger BRL > Lower Inflation > Faster Rate Cut > Stronger Bounce.

Maybe an unexpected strong global recession trumps the logic above, but as of right now I see as net positive dynamic prospectively.

___________________________________________________________________________

WANNA SOUND SMART, SOUND BEARISH. (June 2023)

WANNA MAKE MONEY, BE BULLISH.

Kind of simple, but it works most of the time.

When you watch people sounding bearish to gain reputation it is usually a good sign to do the opposite.

___________________________________________________________________________

DROP SHIPPING (June 2023)

I first got introduced to the concept of Drop Shipping by MadeiraMadeira: they built the concept out of sheer necessity - it was impossible to hold inventory of furniture and still make good returns.

The concept is now dominating low-cost fashion around the globe.

It does not work for high frequency purchases, but it can work for everything else, especially if the items are CHEAP or SCARCE.

Consumers will handle the pain of waiting for those 2 reasons.

This shift in business model is painful for traditional retailers to adapt to.

Requires complete re-wiring of supply chains.

It is, however, adapt or die.

___________________________________________________________________________

Schmuck Insurance in Cap Table Resets (June 2023)

Many company situations require a cap table restructuring: new investors are willing to provide fresh capital as long as the old mistakes by earlier investors do not prevent success from happening.

More than New Investors vs Founders, this pits New Investors vs Old Investors, as all companies need a solid and aligned Management team so the blow to the team is greatly alleviated.

In the New Investors vs Old, the most difficult question to answer is: What is in it for Old investors to go along with the massive cram down?

Try the old and tried Schmuck Insurance: Old Investors participate in upside after New Investors and management make a sizable return first. Say 4x for earlier stage companies and 2.5x for later stage companies.

This idea obviously is only applicable to situations in which Old Investors mostly do not participate in a new solution.

___________________________________________________________________________

ANALYSTS VS. JUDGEMENT IN INVESTMENT GIVEN LLM MODELS (May 2023)

In a not so distance future, analysts that crunch data in investment management will no longer be needed. Inverted pyramids are likely.

You can watch any AI video of people uploading raw company or market data, or a model, and see what AI models do with that.

In private markets, the people left will most likely be those who can perform 2 functions:

1. Relationships with other human beings.

2. Judgement: good decision makers.

If your differentiator is only your ability to crunch numbers, you have a problem (you had a problem before too, but now you won't even get started).

It is very likely that investment management organizations will need WAY fewer people.

For the young generation there is a catch 22 problem: if you are not hired to crunch numbers, how can you "get in" and learn if you have or not "investment judgement"?

Expect interviews that test for that potential instead of your ability to model or produce pitch decks.

Things will change quite a bit.

___________________________________________________________________________

Tech = Productivity Gains (May 2023)

In the history of humankind, new technologies have unleashed massive productivity gains. Those advances were made through war, high and low interest rates, bad and good economic growth.

AI is a new platform that will unleash massive productive growth.

For companies growing a lot, that means adding zero more people as revenue grows. That is the opportunity.

Of course, if all your competitors can also do it cheaper, odds are that the benefit will accrue to the consumer.

The key is understanding how to create unique differentiators, be it via execution, market positioning, regulation, product, you name it.

Yes, there will be way less capital to build. Clear now.

But there is also less need for capital and more need for strategic thinking and use of the new tools.

___________________________________________________________________________

STUMBLING ON A BETTER BUSINESS (May 2023)

In the past 3 years, I have witnessed multiple start-ups expand organically or via M&A into an adjacent business line that looked promising and then figured out the adjacent is the actual business down the road (90%+ of the NPV).

If that happens, KEEP IT A SECRET.

No need to tell the world while you have 0.1% market share.

___________________________________________________________________________

ANSWER WITH SOFTWARE NOT WITH LAWS (May 2023)

The city of São Paulo just launched a 10% flat take rate app to compete with Uber.

Will it work well or not? We shall see. Probably not.

However, it is smart to see governments responding this way instead of regulation.

As the cost of software development collapses, I believe we will see many new initiatives like this in the future.

___________________________________________________________________________

COMMUNITY (May 2023)

Nothing is more valuable than a sense you have people who will help you if you need.

If you face life with the philosophy that you always exist to help, then you get helped when it is your turn.

The only caveat: only works if it is genuine interest in others' success.

Beautiful to watch.

___________________________________________________________________________

ASSUME YOU DO NOT KNOW (May 2023)

The biggest difference between investing in public mature companies and private start-ups is the frequency in which your prior assessments are outdated and no longer valid.

So often I meet a company that I have not met in the past 12 months, and either they are doing much better than I assessed, or something happened, and they are struggling to solve a new problem.

As a result, it is better to assume you DO NOT KNOW unless you have seen real detailed recent data.

Of course the job is not to get things right in the short-term, but rather in the long-term.

With that lens, it is important to see what happens when companies struggle: how they solve the problem. It becomes a predictor factor in how they will solve future problems.

In fact, it is a bit dangerous to invest in companies which you have not observed them dealing with adversity.

KEEP AN OPEN MIND.

___________________________________________________________________________

Companies, founders, investors, artists, politicians all go through phases. (April 2023)

Sometimes they look and feel invincible. Smart and clever beyond a doubt.

Other times they look like idiots. Out of touch. Done.

Neither extrapolations are true. We all know they are not true, yet we all fall trap to extrapolation thinking, especially at turning points of optimism or pessimism.

Time to be a bit more Stoic.

The only certainty is that if you never look like an idiot either you care too much about what other people think or you are not trying enough to take good risks.

___________________________________________________________________________

Super pleasure collaborating with Pedro Faria and the Kamaroopin / Patria Investments growth team on this study about the asset class historical performance and prospects going forward! (April 2023)

___________________________________________________________________________

Chat-GPT Exercise for Founders Fundraising: (April 2023)

Ask Chat-GPT the following questions:

1-) what is the competitive dynamic in “XYZ” industry in the globe and in “Brazil”

2-) what are the distinctions of “ABC” company and its competitors

3-) what are the strengths and opportunities of company “ABC”

4-) what are the challenges and risks of company “ABC”

This will create a quick memo about company “ABC” based on what is out there.

Then re-write the memo with your knowledge of your company and your competitors.

Be ready to hand both to potential investors proactively.

This avoids the risk that they form an opinion based in Chat-GPT.

It will happen.

___________________________________________________________________________

Butterfly Effect: SVB, Recession and Consolidation (April 2023)

The implosion of SVB is likely to lead to a US recession and a consolidation of both the US banking system and of the Venture Capital industry.

The reason why the SVB crisis was so predictable is because the analysis was so simple and easy to do. If liquid tradable assets were marked-to-market, no equity would be left. Everyone could see it. The more people saw it, the more would move money out of SVB and the self-fulfilling nature of the demise had a high probability of being unstoppable.

It did not help that tech entrepreneurs are a tight community very addicted to social media. The elements for a classic bank run were set.

As George Soros so brilliantly put in his Reflexivity Theory, sometimes reality does not matter and the perception of reality changes reality. Nothing is truer in bank runs. If nobody ever redeemed their deposits, after 5 years SVB would have been fine. It would have printed a low ROE versus its opportunity cost of capital, but it would be fine. The withdrawals crystalized the lower ROE all at once and showed the bank was swimming naked.

Attempts by Venture Capital firms and entrepreneurs to be loyal, while honorable, turned out to be futile as the equilibrium state in the situation’s game theory was to take your money out.

It was also Reflexivity that predicted the next leg: if uninsured deposits were to take a haircut, then I must take my money out of any similar bank as the risk-reward had become highly asymmetric to the downside. This triggered the Treasury to guarantee uninsured deposit holders of SVB. Unusual and potentially costly in the long run, but it was important to prevent contamination of other regional banks.

If going forward all uninsured deposits in the U.S. are guaranteed by FDIC, multiple unintended consequences will follow, but they will only be felt over a longer period.

Moral Hazard increases as bank CEOs believe their deposits will always be there for them, leading to riskier lending. There are offsets to this problem including the creation of tiered pricing for the FDIC insurance paid by the banks.

Regional Banks regulation is likely to increase given that today they face way less strict rules than too-big-to-fail banks. Arguably, the Regional Banks bank run we face is a direct result of the poor application of even the existing rules.

Consolidation could ensue as regional banks may not be able to cope with the costs of additional regulation.

Political backlash as depositors can be seen as yet another group of wealthy people benefiting.

Despite the efforts to guarantee depositors of SVB, the bank run continued. Last Thursday, in an unusual step, the big banks deposited $30 billion into First Republic Bank. This solution could avoid the necessity to increase funding and mandate of FDIC to deal with all uninsured deposits, which would have to go through Congress and be subject to political debate.

Moreover, one simple way companies can protect themselves is buying treasury bonds directly via mutual funds. The problem is that it drains funding to the banks, which means banks have less money to lend to individuals and corporations. A very undesirable effect. The so-called multiplier effect of money diminishes.

2 weeks ago, nobody was certain that the US would enter a recession. Now odds of that increased considerably, which triggered a sharp reduction in the interest rate curve as investors react via Flight to Safety. The silver lining, at least temporarily, is that lower rates is good for tech sector.

The need for increased regulation of regional banks is real. SVB, for instance, lent money to founders against their equity stakes, lent money to Venture Capitalists against future carry, lent money to VC funds to optimize fund IRR, invested in many VC funds as LPs. All in exchange of managing the cash of the companies. However, that cash is owned by all shareholders of the company, many of which do not benefit from the loans and investments. Moreover, LPs of VC funds also do not benefit from these strategies to lock-in SVB customers. Conflicts of interest are never free.

The SVB debacle comes at time when US institutional investors are already trying to reduce exposure to VC and growth equity funds. It will likely further shake confidence and trigger consolidation in the VC industry as many funds will fail to continue. It should also bring the topic of conflict of interest to the forefront.

In the long run, it will all be fine. But expect a turbulent next 3 years. Great time for investors with fresh cash. Tough for founders. However, out of rough times brilliance emerges.

___________________________________________________________________________

Maybe useful to read George Soros’ Reflexivity concept to understand what happened to SVB and to understand why all depositors must be made good or this thing is going to spread like wild fire. (March 2023)

I am not talking about bailing out equity holders of SVB. I am talking about guaranteeing all depositors in full otherwise a huge portion of other businesses’ deposits in smaller banks will migrate quickly to the big banks that are too big to fail.

I do believe in capitalism and moral hazard, but first you stop the spread, which is arguably faster nowadays with social media and all.

In sum, this is such a serious situation that I believe it is highly likely we have a solution for depositors by tomorrow morning.

Cheering for no policy mistake like Lehman.

https://www.investopedia.com/terms/r/reflexivity.asp

___________________________________________________________________________

MUTUAL FUNDS ARE SAFER THAN BANKS (March 2023)

A money market mutual fund that invests in super short-term treasuries is Safer than any bank.

It’s why we save for our retirements using Funds and not Savings or CDs.

It has NO Leverage.

The architecture is designed to not depend on custodian credit risk.

Cash ETFs are also safer.

It is also regulated.

___________________________________________________________________________

The Deel Problem (March 2023)

By taking away friction of hiring people around the globe, Deel makes the world more equitable: it allows for talent to be priced more similarly regardless of where talent lives. This is specially true of engineering teams.

If you are a Latam company, your philosophy on engineering talent needs to shift to "Global" because your best people will be picked up, sooner or later, by a global client of Deel.

In the long-run, Deel solution allows for skill arbitrage, which means talent in the US will make less and talent in emerging markets will make more - most likely, actually, EM talent cost will rise closer to US talent cost.

This has profound implications for companies serving just Emerging Markets. Your company has to be big enough to compete with the best Global start-ups for engineering talent, not just competing with local start-ups.

___________________________________________________________________________

I am seeing more and more companies getting to break-even and positive monthly cash-flows. (March 2023)

Necessity is beautiful.

And even better, these are companies doing so without jeopardizing their future!

Not super common yet, but it is happening way more frequently now than 1 year ago.

___________________________________________________________________________

Super pleasure discussing ideas with Mariana Fonseca 🚀 and Latitud about growth equity in the future in Latam!! (March 2023)

https://www.latitud.com/blog/paulo-passoni-venture-capital-series-b-startups

___________________________________________________________________________

In the last 20 years, 2 world class companies have emerged from the Latin American tech ecosystem: Mercado Libre and Nubank. (March 2023)

This is how rare truly great companies are.

Both of these companies are just getting started. They have so much ahead of them and so much more to conquer.

Now with their scale and technology advantage, catching up to them is really hard. Hard to both new tech companies as well as incumbents.

In fact, their competitive advantage gap is likely to further increase vs their competitors in the next 5 years.

If you are an equity investor in Latin America, these are 2 names you put away as core positions and you create a rule not to touch them for 5 years. Trying to outsmart oneself trading them will likely only lead to regret when looking back.

I feel quite excited to try to find more companies like these.

If I had to make a wide guess, the next 10 years will give us 2 or 3 companies as good as MELI and Nu. The ecosystem is bigger and the innovation engine has been turned on – hard to turn it off.

___________________________________________________________________________

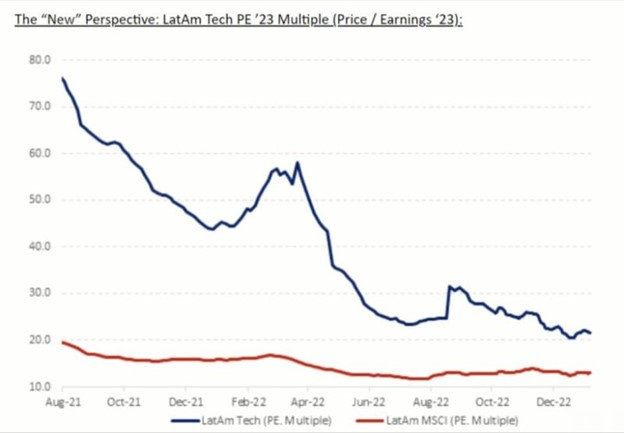

P/E vs Rev or Gross Profit Exit Multiples (March 2023)

The biggest mistake everyone made in the end of the last cycle was not driving exit multiples by P/E ratios, instead using Revenue or Gross Profit multiples.

Obviously all one needed to do was to calculate the implied P/E multiple of any Rev multiple to see how wrong the assumption was.

That mindset is over, yet it is hard to unlearn. Some keep using Rev multiples.

A good indication of this significant change is the graph below: Latam Tech companies P/E multiples vs Latam MSCI: as you can see, the period of living outside reality is over.

Thanks Pedro Gomes Pereira for the graph.

___________________________________________________________________________

TIME AS RISK (February 2023)

When you invest in mature or declining businesses, time is risk.

With time, more bad things can happen than good things. You want to come in and out as quickly as possible.

An old letter by Paul Singer of Elliot talks about that. The more time goes by, the less well you sleep at night.

With world class growth companies like Microsoft, Apple, Mercado Líbre, Nubank, Time is your Friend.

More good things than bad things can happen. You can let these Net positive things compound. You sleep well at night because you know the ship is in good capable hands: combination of great business still growing and great teams.

In fact, the only way to invest in growth equity is to have a long-term almost private equity like mindset because when you are not there for the massive good days, your return is not nearly as good.

Kudos to people like Phillipe of Coatue who sensed trouble and exited all risk in late 2021.

But what he did is not easy to do and very hard to replicate.

I am not against market timing in extreme bullish and bearish outlooks, but as Howard Marks puts it, you should only have that action very very seldomly - maybe once a decade.

___________________________________________________________________________

Proprietary Data Sets (February 2023)

The Machine Learning revolution has 3 legs: data sets, algos and processing power.

Of the 3, the likely differentiation between winners and losers, in my opinion, will be proprietary data sets. Data "gates" are coming soon. Grab the data before it is too late.

It is funny that Quant Hedge Funds like Renaissance Technologies have relied on Proprietary Data sets to generate Alpha for the past 30 years. It rhymes.

Winners on the infrastructure side will be companies like Cloudefare.

On the actual algo side there might be companies much better than Open AI like Stability AI.

There is a lot of people hiding their tools to avoid competition.

Hiding your product reminds me of incumbent banks in Brazil who in the past "saved profits" not to post too high ROEs in good times and avoid political backlash.

Whenever people are "hiding/protecting" their product/idea, you know something of value is there.

___________________________________________________________________________

Owning Your Mistakes, Victimization and Ego (February 2023)

More and more I hear stories that goes like this:

- Fund X made me grow like crazy

- The secondary of the founders destroyed the culture and took away the incentive to work hard

It is not easy to be a founder. But healthy behavior is to own, or even over own, your mistakes and never blame others for it. It is the only way to assimilate that a change is needed and to be in the driver seat in life, as opposed to a passive passenger.

Victimization is one of the least attractive traits you can portray.

Often times we do not own our mistakes because of ego: unconsciously we cannot admit to others we made a mistake. Exercise leaving the ego at the door.

You look WAY better to investors, your team, your partners when you own your mistakes. It shows you can now change course and do something different.

Imagine if I told other investors all the investment mistakes, I made in 2021 were because of the “market conditions”. That would be laughable and pathetic. Worse, I would not have learned anything from that and would likely repeat the same mistakes at the end of the next cycle.

You, and only you, are ultimately responsible for how you grow, the business model you choose, the cost-conscious culture you create. That’s it.

___________________________________________________________________________

Business Model Change (February 2023)

When existing business models are simply not working, I get way more excited to hear founders talking about big changes rather than 10-20% improvements in the existing way of doing things.

Yes, big changes are scary, and probability of success is anything but certain.

But what is certain is failure if you insist in a bad model.

As the saying goes, the definition of insanity is doing the same things and expecting different results.

Be realistic. Be bold when the core is not working. Forget what you told people before.

___________________________________________________________________________

Regulatory Capture in Latin America (February 2023)

Most people born and educated in Latam know this already, but the region suffers from High degree of regulatory capture, as Insper economist Marcos Lisboa so clearly explains.

Regulatory capture exists everywhere around the world, and in Latam it manifests via:

- Tax policy: local complex taxation and import tariffs;

- Anti-trust policy: the region is home to many monopolies and oligopolies and new transactions are often approved that make no sense;

- Authorizations and approvals to operate: often not available for new entrants on the basis of some kind of risk to the system.

Obviously some regulation is critical. But in Latam the end result is some industries that earn a consistent Return on Capital that is much higher than their international peers even when adjusted for the region’s higher cost of capital.

Some entrepreneurs are disrupting small businesses and won’t face this risk as the opponents are not organized.

Others by definition will face them if they succeed. Often the reaction only comes when you start to dent the abnormal ROEs, so it usually comes very late. But when it comes it can be really destructive.

The regulatory capture is supported by both right and left wing politicians.

The population should want and benefit fair prices, but under the disguise of local jobs or local champions it exists.

Very difficult topic to resolve.

Like a good chess player, when you start getting serious size you need to have a well thought out government affairs effort.

___________________________________________________________________________

Closing the Loop on Exit Multiples (February 2023)

Apart from (a) earnings growth and (b) cost of capital, there are a few super important factors that drive multiples, which makes the job of picking the right one a bit of an art.

CAPEX: companies that have high maintenance capex as % of revenues will trade at much lower multiples than companies with low % or no capex at all (which tends to be the case for tech-enabled companies).

WORKING CAPITAL: some companies, like Amazon e-commerce, generate cash when they grow revenues. That can create a weird dynamic whereby the Net Income is poorly correlated with Cash Flow. As a result, Amazon traded at “high P/E” multiples for a long-time for a good reason. However, most companies do not have negative working capital like Amazon. Most tech enabled companies have no significant working capital requirements. But if they do, it can impact multiples positively or negatively.

CYCLICALITY: some sectors are subject to strong cyclical forces, including tech enabled companies (example: tech companies in transportation). At the peak of the cycle, the companies will trade at LOW multiples because the market is smart and anticipates mean reversion. At the bottom of the cycle, they will trade at HIGH multiples. Funny enough you should enter cyclical companies, as an investor, if the multiples are high. Behind this effect is the notion of a “Normalized” pricing and margin level. Ideally, you would calculate the multiple on “Normalized” if that is well stablished.

RETURN ON INVESTED CAPITAL: this is the most critical. When companies are not returning free cash flow to shareholders in the form of dividends or buy-backs, then the Return of the marginal re-investment matters a ton. Most companies are not disciplined about making sure the marginal return is solid, which means future returns lower than the cost of capital. If that is the case, the company will trade at a discount and lower multiples. The inverse is also true. In fact, if you do have opportunities to invest new money at say 40% IRRs, then investors will expect full re-investment (if you start distributing cash flow you will have to explain why).

BIG NON-CASH FLOW GENERATING ASSETS: if the company has assets that don’t generate cash flow but are valuable (example: a big stake in another company), then it will trade at a high headline multiple. Often times the Market Cap will be adjusted for such assets to calculate a more “clean” P/E multiple.

BIG NON-CASH FLOW LIABILITIES: when companies have big lawsuits that can destroy future cash flow, for example, or if it made guarantees on products that are not backed by assets, then likely it will trade at a multiple discount. The famous case in old school companies is unfunded pension liabilities.

FUTURE CHANGES IN TAXES: if companies have managed to avoid income taxes and that is about to change, the market will reflect that in lower multiples. Similarly, HQ inversions may create an increase in the multiple. Taxes matter a LOT.

STOCK COMPENSATION: If RSUs are used, then accounting should capture the effect at the Net Income level. If out-of-the-money options are used (like homerun options for CEOs), it may not as it depends on strong price performance. However, markets are smart and the existence of such highly dilutive packages may decrease the multiple the company trades at. And yes, stock-based compensation SHOULD decrease Net Income (adjusting Net Income for this is a huge red flag).

GEOGRAPHICAL EXPOSURE: If a company is heavily exposed to countries like Russia, Venezuela, etc, it should trade at a multiple discount because those countries are cheap for a reason (example: capital convertibility back to USD is non-existent).

In sum, a “multiple” is just a short-cut for future cash flow. It is a useful one in most scenarios. But one has to be aware of factors like the ones above to properly calibrate them. Growth and cost of capital, however, are by far the most important factors.

___________________________________________________________________________

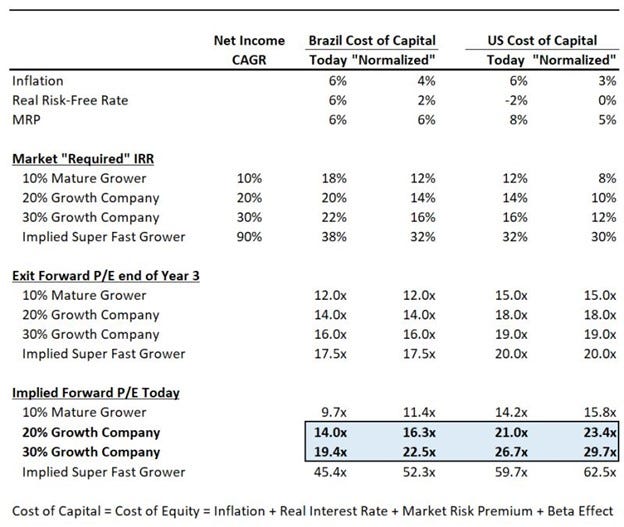

How to Think of Exit Multiples? (Some Nuances) (February 2023)

2 valid questions could have been asked of yesterday's post on Exit Multiples:

1-) By the time the company IPOs, inflation and interest rates will likely normalize and multiples will expand. What happens if one uses a "Normalized" required Cost of Equity/IRR?

2-) Growth investors tend to ignore differences in cost of capital between Brazil and the US, thus using a more Global/US Ke. If one uses a US Ke, what is the implied multiple today?

The table below answers those 2 questions. Some take-aways:

- The impact of moving to "Brazilian" normalized cost of equity is not that significant > exit multiple only increases by 2-3 turns.

- The big difference is being considered a "US company". This can cause a 6 to 8 turns increase in the multiple.

In my career I have seen global investors not use local cost of equity many times. It is intellectually wrong for many reasons, but it happens.

Lastly, these are P/E multiples. If you use EV/EBITDA got to use lower absolute numbers. For example, a 30x P/E is equivalent to something like a 20x EV/EBITDA multiple assuming 30% taxes and no debt in a company (and high growth companies usually have almost no amortization charges).

The exercise also aims to illustrate that after a certain Net Income CAGR, a company does not benefit linearly from it. Another way to think about it is that the IRR required of super high growers is actually quite high.

___________________________________________________________________________

How to Think About Exit Multiples for Private Growth? (February 2023)

If you are a high-profile private growth equity company, your prospective investor is going to price your company today based on how the company is likely to trade as a publicly traded company in 5 years from now (plus some scenarios).

The multiple your company is going to trade at, in turn, will depend on how quickly your Net Income will be growing from the moment of the IPO to 3 years forward.

Most entrepreneurs overestimate at what multiple their companies will trade at exit, especially in today's World.

Below is an exercise using today's cost of capital (i.e., the required marginal IRR for a 3 year hold).

- Let's start with a Super Fast Grower: the multiple is today 45x forward earnings because if the company delivers on its estimates, it will be "created" at 6.6x forward end of Year 3. Note that the implied IRR is super high because with super high growth comes super high perceived risk (Hint: this company exists today).

- For a 10% stable grower, the multiple today is 9.7x forward P/E. If you hold for 3 years the IRR is 18%, which is a premium to the Brazil 3-year forward interest rates, as it has to be (implied in the small exit multiple expansion is an assumption that rates will come down by then).

- For a 20% Growth Equity company, the multiple today is 14x P/E or 9.8x EBITDA. I see founders thinking that they will trade at 20x+ P/E if they are growing at 20% prospectively. This exercise shows how that is not the case, unless short-term interest rates drop dramatically.

- For a 30% Growth Equity company, the multiple at IPO is 19.4x.

Hopefully this helps imagine the value of your company 5-years out better and in turn help understand the value of your company today.

Note: the required IRR as a private company today is at least 30%.

___________________________________________________________________________

China (February 2023)

Around August 2022, the world was peak bearish on China.

“China is uninvestable”.

I must say I even believed that for a second.

China is reopening and with that comes a wave of bullish calls on China.

China tech complex bounced back more than 50% already.

Southeast Asia, which the West often associates as a derivative of China, is now the hottest place in the world to allocate capital.

The implications for Latam are net positive too:

- China reopening is bullish for commodities, which is bullish for Latam -> Latam does well in good commodity cycles

- Longer-Term, the ESG restrictions on global commodity supply is also bullish for commodity prices

- On the negative side, inflation is more concerning -> if commodity prices go higher that could necessitate higher rates for longer

- On flows, the hope that “Latam is the only place left to invest” and therefore we will see a lot of new money, was a bit too optimistic and I don’t believe will happen.

___________________________________________________________________________

Meritocracy is your friend (February 2023)

It is non-sense to believe meritocracy is the problem.

In fact, the vast majority of companies still lack systems, processes and culture to enable it.

If meritocracy were the problem, then the opposite system would produce amazing results and we would still live in Feudalism.

Get causality right.

___________________________________________________________________________

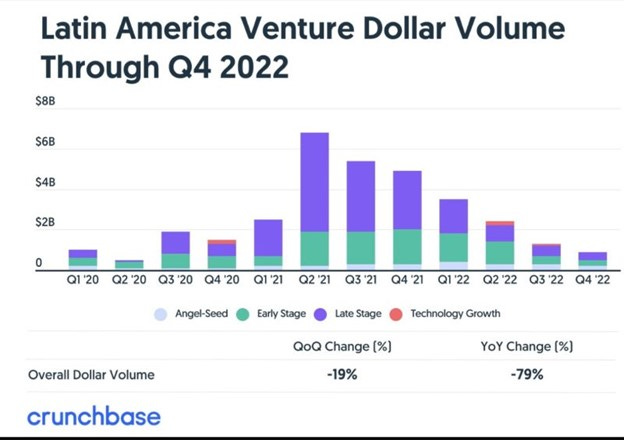

Latam Venture investments will come back, but nothing like 2021 for a while. (February 2023)

Major problem for the purple bar (late stage) is valuation vs public markets.

___________________________________________________________________________

Free Idea for New Entrepreneurs (January 2023)

Vertically Integrated IVF health operator selling to all major companies as a MUST cover for all the women in the workforce.

Focus on one thing: Lower costs. Better experience.

Basically KindBody for the top 25 Cities of Latam.

___________________________________________________________________________

Investment Cleansing (January 2023)

At the beginning of my garden leave I could not have imagined that it would serve as an amazing investment cleansing precisely after the most dangerous period for investing in the past 20 years.

Lucky to be home. Lucky to detox. Will be really fresh when I restart.

Better lucky than good.

___________________________________________________________________________

With lower valuations starting to trickle down the chain all the way to Seed, it means founders will have less money to build their companies (the dilution levels aren’t likely to change that much, rather the amount of money raised will come down 50-60%). (January 2023)

Roughly speaking, there are two sides of building a company:

(A): Product, which requires engineers and coders.

(B) Go-to-Market, which requires people and mkt expenses.

The interesting thing about AI is that it is likely to make Part A way cheaper. Productivity in writing code ought to increase substantially in the future.

The part that worries me the most is Part B. In the past cycle, a big chunk of VC money was often ending up at Google or Facebook in performance marketing for B2C companies or lots of expensive sales people for B2B businesses.

The new reality on money available will force more creativity and ingenuity on the efficiency of Part B.

Granted that companies like Nubank were ridiculously efficient in part B even in the prior cycle.

Perhaps worth being a bit more patient on product development until it “sells itself”. Little enthusiasm for marginally better products and services.

___________________________________________________________________________

When you catch yourself “hoping” for anything, you should do the inverse. (January 2023)

“I hope the new economic team does the right things” - > you should sell all the risk.

“I hope this new company cuts costs” -> you should sell the stock.

“I hope this start-up cuts burn soon” -> they are definitely behind the curve.

Hope is a great predictor of when you are in the wrong side of the bet.

It shows an emotion of cheering for an outcome as opposed to being ruthless about the facts.

Decision making is ruthless

___________________________________________________________________________

2023 Wishes (January 2023)

Wishing Latam growth equity companies to be on track during 2023 to go public in 2025 at the same valuation reached in 2021.

If you are on track for such path you are better than 80% of companies out there.

Companies going public at a valuation above 2021 levels will be rare.

The multiples were so wrong in 2021 that 4 years to “grow into them” will be needed for the top 20% performers. The bottom 20% will not exist. The middle 60% will be a mix of selling to strategic, lower valuations and weird dynamics in the cap table.

Implications:

- Secondaries must, on average, occur at 40%++ discounts to 2021 valuation.

- Mark-to-market must go down to yield appropriate risk-adjusted marginal returns (if the level is 20% or 30% is dependent on each house’s policy).

- Stock-based compensation will shift towards “RSU”/Low strike price otherwise those who receive it will not value it.

___________________________________________________________________________

THE CRAMDOWN ROUND (January 2023)

It is inevitable that some companies will need capital. A few can try to never raise capital again until IPO or sale to strategic, however most will need more capital. When that happens, the probability of a cramdown round is quite real.

The minority of companies that may avoid cram downs are the ones which (a) received rounds at reasonable multiples in the 2020-2021 period, (b) are growing like rockets with increasing gross and operating margins, and are in (c) big markets.

Most late-stage investors were looking at $10Bn+ outcomes, but the truth is that those outcomes are rare. What is more likely for “successful” outcomes are companies worth $1-5Bn because the exit multiples were wrong alongside margin assumptions. The table below illustrates what that means for Pre-Money value today.

Exit Value (US$MM) $1,000 $5,000

Required Return Today 35% 35%

Holding Period (years) 5 5

Post-Money for New Investors $223 $1,115

Cash-In (New Round) $56 $167

Pre-Money for New Investors $167 $948

% Round Dilution 25% 15%

% New Stock Award 10.0% 7.5%

Pre-Money for Old Investors $151 $877

So, one can easily imagine how we are likely to witness a series of down rounds. In those rounds, the existing investors who do not participate with at least their pro-rata are very likely to get diluted by not only the new investors injection, but also by a need to incentivize management and team.

Some early-stage investors without follow-on funds and most angels will get crammed down.

The down round dynamics will force late-stage investors to pony up on companies important to their NAV. Note: it is not about “protecting ownership” – that concept makes no rational economic sense. What matters, simply, is marginal dollar returns.

Also worth noting that with the new down round, a brand new governance is likely to follow as the most likely investor in such a dynamic is already a large shareholder.

For really large companies with high probability of IPO and a big cap table of preferred, one alternative is to raise a convertible that gives an investor a ~15% guaranteed return to IPO, however long that takes. That instrument has to be a small percentage (max 20%) of the preferred capital stack. Most of those big companies do not need capital. This type of financing only makes sense in the context of M&A or similar value creation opportunity.

___________________________________________________________________________

Bayesian Statistics + Home Bias (January 2023)

Bayesian statistics concepts means that if you know nothing, you should own a global portfolio of equities and bonds market cap weighted (it is the basis for the famous Black-Litterman portfolio theory).

For Latin Americans, that means not having more than 5% of your assets in Latam. In practice, you should have more if you want to retire in Latin America given exposure to Latin American currencies (your retirement liabilities would be denominated in BRL or MXN, etc).

A paper by Josh Coval from 1999 showed Home Bias: a tendency to overweight portfolios on companies where you live. This was done for US equities in US regions. But the same concept applies globally.

As Avenue posted R$1Bn of flow just last month from Brazil to US, the theory met practice, although 20 years later. (Roberto Lee).

___________________________________________________________________________

MIN OPERATING CASH BALANCE (January 2023)

No company can operate with zero cash-in-hand. There is an important and simple concept that a certain minimum amount of cash represents required working capital to run the business well.

In my experience that min cash balance ranges from 5% to 10% of annual revenues. It can vary greatly from business to business.

It is important that start-ups calculate their runway up until running into the min operating cash balance, NOT to zero.

This shortens the runway perception and means sooner than later raises will be required.

When your cash runs low, you are forced to make bad deals with customers and suppliers, which then puts a lot of pressure on your margins.

Got to stay away from that Death Spiral.

___________________________________________________________________________

Check out Michael Mauboussin’s latest excellent piece of capital allocation. For big companies, a must to master. (January 2023)

__________________________________________________________________________

For those who love investing, Alix Pasquet is a must follow. (January 2023)

Here’s another piece from him that is pure gold.

Great for PMs and analysts of funds of all types.

Enjoy.

___________________________________________________________________________

Founders of all types: (January 2023)

Get used to preparing Balance Sheet, Income Statement and Cash Flow Statement every quarter in ADDITION to managerial tables and KPIs.

There is a reason why accountants created these useful statements and you might be completely missing the boat on things like:

- Guarantees

- What is debt vs not

- Working capital changes

- Proper Accrual accounting of P&L, which if not done properly can completely lead you to the wrong margins assessment

- Proper Statements in essential to measure return on invested capital, something all of you should be calculating

And if you are in multiple countries, got to do Statements for each country separate.

It maybe that VC investors will not even bother asking you for these Statements, but growth equity investors will definitely do.

Time to mature as if you were a publicly traded company.

___________________________________________________________________________

BEHAVIORS IN BOARD MEETINGS VS. SHAREHOLDER MEETINGS (January 2023)

As times get tough, many board members representing shareholders forget that their duty on the Board is towards the company and NOT towards their fund.

Some board meetings have started to resemble Shareholder Meetings more than Board Meetings. In Shareholder Meetings it is ok to maximize for oneself. In Board Meetings it is not. Sometimes the lack of awareness happens because the board members are just young and inexperienced.

A few potential problematic behaviors at this juncture of markets:

- Board member of a fund that no longer has capital to invest in the company: will prioritize safety of future cash flows at the expense of high-quality value creation out of fear of increasing likelihood of a round and the potential dilution associated with it;

- Board member of a fund that has more capital to invest in the company and has small ownership currently: on purpose advise founders to press the gas paddle knowing that when a round comes, one can take massive advantage of it and gain ownership squeezing those that cannot follow.

- Some investors are worried about mark-to-market of their portfolios (and this may be of the individual not even the overall fund) and last thing they want is an event that crystalizes current value.

The conflicts of interest do exist and are exacerbated in moments like now. Bad behavior can happen even with representatives of excellent funds. VC land reminds me of law firms: some big name law firms partners are great lawyers, some are not.

My recommendation is for founders to have very honest conversations with board members if they fear potential bad behavior driven by conflicts of interest. Misperceptions may form by both sides.

Credit to my friend Carlos Medeiros for the framing of the problem.

___________________________________________________________________________

There is something beautiful about games where both skill and luck play a role in outcomes. (January 2023)

True in football/soccer, true in investing.

___________________________________________________________________________

TOP-DOWN VIEWS & THROWING THE BABY OUT WITH THE BATH WATER (January 2023)

Negatives:

“With rates up, Real Estate sector is done!”

“Tech sector is over”

“Crypto is all a scam”

Positives:

“The future is the metaverse”

“All retail will be destroyed by Amazon”

I very much dislike top-down views. Of course sometimes they work and have to be understood. But more often than not, they completely fail to distinguish between good and bad companies in the same sector, between good and bad assets in a particular city, between good and bad operators of similar enterprises.

Moments like we are living today produce “Geniuses” that proclaim “those so-called real estate geniuses were simply riding a multi-decade wave of interest rate cuts”. Similar argument to technology “geniuses”. Of course everyone benefited from rates, but some people ALSO really know what they are doing.

The wrong conclusion is that you should now avoid sector A or B.

My view is that it is precisely now that you want to hire experts in sector A or B to find out the good assets or companies thrown out with the bath water. Those are multi-bagger (where you can multiply your capital) opportunities. The “source” of the mispricings are high conviction top-down views that are very wrong when applied to every single company it refers to. It can certainly apply to even the majority of companies of a sector. But it is almost never true of 100% of them.

The opportunity for the expert investor is to figure out the minority of excellent companies that become priced like every other “similar” company and make an outsized return.

Times like we are living now are when you lean-in on expertise.

___________________________________________________________________________

Recession & Your Mid-Term Planning (January 2023)

Since 1950, the average recession lasted 10 months. Since 1854, the average recession lasted 17 months.

Assumptions:

- Recession starts in 1Q23.

- Markets are forward-looking and bottom 6 months before the end of recessions.

- Investors need 6 months of markets rebounding to get confidence to invest in private growth companies again.

- Companies cannot have less than 6-months cash-in-hand.

Under these assumptions, your run-way should be between:

A-) March 23 + 10 months Recession - 6 months Market Forward Looking + 6 months Private Market Confidence Building+ 6 months Company Cash Reserves = August 2024

B-) March 23 + 17 months Recession - 6 months Market Forward Looking + 6 months Private Market Confidence Building+ 6 months Company Cash Reserves = February 2025

If your current cash-in-hand does not last until Aug 24 to Feb 25, you need to:

X-) Cut costs without cutting gross profit contribution.

Y-) Raise capital ASAP. Regardless of dilution. If you hit zero cash, equity is worth zero.

This is the reality of today.

For people who work in VC backed companies, this is what it means to be in the shoe of the CEO/Founder. If they are not doing adjustments, it is actually a bad sign.

___________________________________________________________________________

THE IMPORTANCE OF M&A FOR GROWTH COMPANIES (December 2022)

M&A for more mature/growth stage companies is an essential skill, yet it is quite risky.

The risk comes from a need to completely shift the mindset from operator to capital allocator. And not all operators become good capital allocators.

It also must match the strategic long-term goals of the company. It cannot be random.

A few common rules of thumb:

- Avoid defensive M&A moves – the logic of doing them starts from fear and nothing good can come from that angle.

-Think about the M&A decision in terms of (a) % of the combined company value and (b) % of your cash resources. 1-5% decisions are “acquihire” and all you should care about is the quality of the team you are buying and what they can do for you. The “real” M&A decisions are the ones above 5% of (a) or (b).

- Information asymmetry is key: offer first all-cash deal. If the company accepts that right away, walk away from the deal. No good target should want an all-cash deal.

- Good M&A are often the ones that expedite entry to an adjacent segment, not the ones that aim to fix the “core business”. If you need to fix the “core business” do it organically first.

- It is super important to be “in-the-market” for M&A turning every rock. Sometimes, you can turn a rock that stinks but your competitors may fear you will buy that rock and you should be happy to create tension for the target and “help” your competitor destroy value by allocating capital wrongly.

- Be counter cyclical: when the market is hot do less M&A; when the market is down do more M&A.

- Geographical expansion M&A should prioritize quality (buy the #1 or nothing). And quality is available only once in a while – when it is, you must find a way to act.

M&A should be led by CEO and CFO. A good head of M&A is more than just a banker – it is an investor who has a history of good returns. Most companies, however, do not have this skill in-house. It should not be outsourced. You must build a good team and this has to be treated as a priority by CEO/CFO.

Good M&A may not only create a ton a value, but it can also help you become a much bigger company which is quite important for exit alternatives.

___________________________________________________________________________

If I were looking for ideas of businesses to start in Latam, I would study OpenAI and what can be built on top of that specifically for local problems. (December 2022)

___________________________________________________________________________

Just like PIX, there is an obvious opportunity for a government led system of healthcare information protocols that are open and free to all participants of the healthcare system. (December 2022)

I do not believe it can be done by the private sector because data is moat and companies will resist such a system to protect their economics.

Not as easy to implement as PIX, but it is the one "software" that governments shall create and mandate use.

___________________________________________________________________________

My friend Rafael Furlanetti just shared his views on the story of a famous Brazilian entrepreneur, and it rings a huge bell: (December 2022)

1-) Power isolates;

2-) Isolation leads to the wrong read of the situation;

3-) Wrong reads eventually lead to one’s downfall;

4-) After the downfall, people will abandon you.

In summary, your biggest friends are those who tell you what you do not want to hear, when you need it.

___________________________________________________________________________

The episode below about Google on #Freakonomics contains the story and study of plumbers who changed their names to show up at the top of the Yellow Book - turns out those were the worst quality service providers. (December 2022)

Made me think of the following thesis:

- The worst VC backed companies are the ones spending the most on advertising vs their peers to offset their lower quality product.

It is a thesis to be tested. My gut tells me it will be as true as the plumbers.

I also found the episode really awesome to understand how our current internet is worse off today than before by optimizing for advertisers. Not big news, but it explains in pretty simple terms how.

___________________________________________________________________________

I just read a very good report on a high growth company in Latam and when it came to the price target scenarios I felt the range was super tight. My downside case would be half of what was presented and my upside case more than 2x higher. (December 2022)

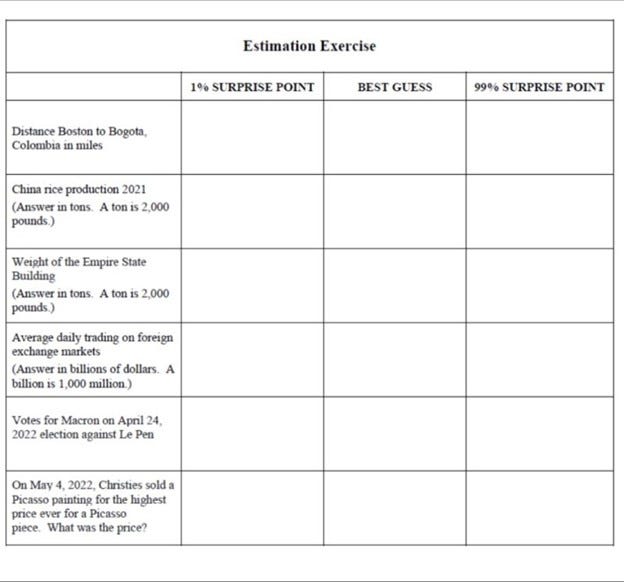

That reminded me about a cool exercise to demonstrate how people are way too overconfident even when warned not to be surprised.

The winner of the exercise below, which ought to be done without Google :-), is to be (a) never surprised on the range you provide and then (b) closest to the “Best Guess” if there is a tie on (a).

In a class of 30 people where I witnessed this play out, ZERO people were NEVER surprised in the 1 to 99% estimates, 2 were surprised ONCE and the rest more than 2 times.

___________________________________________________________________________

In my experience, a wrong short becomes a great long. (December 2022)

I saw that in Enphase and MELI.

Worth studying this new situation.

___________________________________________________________________________

The FTX debacle shows we all get better informed from Twitter than the news. (November 2022)

Yes, there are false claims on Twitter that are dangerous. Requires we all to have judgment.

But there is also an infinite amount of more timely and true information.

The example of the NYT FTX article on what not to do is obvious. The question is: why they wrote such a one-sided piece? Implicitly we get a version of the truth that fits with the political preferences of either right or left wing media.

Elon is after something quite important. That is, if you believe Truth is important.

___________________________________________________________________________

Why you should never buy or sell anything to anyone who has information asymmetry vs. you even if you believe you have very positive expected return? (November 2022)

The Information Asymmetry Test

Story:

Teacher walks into a classroom of 30 people and asks:

What is the probability that 2 people share the same birthday?

Students come up with an answer. Most think it is around 8%. But using proper math, which does not come intuitively, the answer is around 70%.

Then the teacher puts a $100 bill on the desk. Says who is willing to bet on nobody sharing a birthday in the classroom at 10:1 odds.

It's a positive expected bet, but nobody raises their hand.

The teacher waits and improves the odds to the students to 20:1.

The clever bettor jumps in and accepts the bet.

The teacher then asks 2 students in the class to stand-up because they were both born on Oct 5.

Obviously the teacher had researched the birthday of the students prior to the class taking place. That did not occur to the bettor.

The not so clever bettor here was me.

___________________________________________________________________________

What is the problem with 0.1% capital allocations? (November 2022)

- You can easily fall into the trap of not doing diligence;

- It serves as a substitute for conviction. “My conviction is “low”, but just in case let me chip some in”.

- It is often justified on the basis of a “relationship” you want to build.

It is only good if you did all the work and you get haircutted.

The above is particularly problematic in private situations which are not easily reversible. Even though they still apply in public markets.

By forcing yourself into minimum position sizes that are meaningful, like 5%, you diminish the bad behaviors above.

Most of us do it. If not professionally, personally.

___________________________________________________________________________

The Binance-FTX saga will have major implications for the crypto world going forward. (November 2022)

It also shows everyone why regulations exist.

Any bank-like institution can suffer a bank run. This is why government level deposit guarantees exist - basically in all major countries around the world.

Not only that, the idea of leaving regulation to the industry itself did not work and will not work in the future.

Regulation, turns out, protects those trying to create businesses as much as it protects its customers.

___________________________________________________________________________

If someone gives you advice, and you learn the advice is bad because the person was maximizing for themselves and not for you, their reputation drops quickly. (November 2022)

In fact, one of the best ways to learn if you can trust someone is to ask them a question where you know the right answer but in giving that answer the person on the other side has to show you their cards: either they give an answer that is bad for them and you learn you can trust them, or you learn you cannot do business with them.

___________________________________________________________________________

I could keep geeking about decision making forever, but let me bring the posts to a wrap and state one truth: (November 2022)

- The same way you cannot read 1,000 books about tennis, walk in a court and play well even at a basic level, you cannot study decision making and uala become great at it. You must put yourself in decision-making situations and practice, practice and practice by doing it.

One of my favorite books ever is The Yellow Pad below by Robert Rubin, who was the Head of the Prop Desk at GS and later Secretary of Treasury. I won’t spoil too much but the point is to think probabilistically and get into the habit of assigning number probabilities to all things in life.

Rubin has one new book coming out soon. Can’t wait to read it.

I encountered this book because I was about to join Eric Mindich, who worked under Rubin at GS, and wanted to learn how he thought. I find the approach, which is derived from practice, to be highly applicable to a broad range of decisions, especially Venture and growth equity.

The Yellow Pad: Making Better Decisions in an Uncertain World

https://www.amazon.com/dp/0593491394/ref=cm_sw_r_api_i_GK10ZMAB0PB50Z83M48F_0

___________________________________________________________________________

Michael was a speaker at the recent Zeckhouser course on decision-making. (November 2022)

This podcast is excellent and timely.

___________________________________________________________________________

7 maxims on decision making: (November 2022)

1. Errors of commission feel way worse than errors of omission, however both are equally important. One needs to develop a tracking system for errors of omission given that the tendency is to ignore its existence.

2. It does not matter when you learn new facts. It is common for private investors to get too committed to investments and ignore new facts if they come at the end of the investment process.

3. You hire advisors so that they can tell you how you can be wrong, not how you are right.

4. Make implicit reasons for a decision explicit. It will help reveal assumptions and their reasonableness.

5. All crises start with a boom.

6. Beliefs are hypothesis to be tested, not to be protected.

7. Before investing stop and ask: does my counterpart have asymmetric information. For example: you should not have most of your investment going to buy secondary from young founders. Even if you believe you have a great expected IRR.

___________________________________________________________________________

The Hipo and the Pre-Mortem Analysis (November 2022)

Hipo = Highest Income Person Opinion. He or she tends to dominate any decision-making discussion and can narrow quite a bit the conversation topics in what they think are the most relevant points. And granted, often they do have the most experience and ability to ask the right questions.

Whenever you observe a narrow tunnel vision of the future in a decision-making conversation, one key suggestion is to perform a Pre-Mortem analysis.

In the Pre-Mortem you assume the decision was a fiasco. Then you generate a list of reasons for why it was the case (requires good imagination). If a group of people are in the room, it is best if each creates their own lists and then all options are consolidated. Then engage in a discussion of what is the probability of these reasons for failure and re-asses the decision.

The Pre-Mortem is also particularly effective when you see the group or the HIPO be way too optimistic. Lastly, it is also a test on the process itself: failure to imagine different ways you can lose money or make the wrong decision is a signal the decision was not well thought out yet.

___________________________________________________________________________

Let's start with a mental exercise: (November 2022)

1. Name the best decision you made in the past 12 months.

2. Write down why it was the right decision.

Take a break.

Did the decision end up with a good outcome?

I can predict with 90%+ probability you said Yes.

This is how we humans tend to judge a decision: by its outcome, not by what was knowable at the time of the decision.

If professional poker players thought this way, they would not be professional.

Same is true of investors with a long-term track-record of success.

The objective is to have a Good Investment Process. Outcomes for unique events are dependent on luck as well as skill.

But how do you know if you had a Good Investment Process?

(a) you considered all knowable factors that are relevant to the decision ex-ante,

(b) you used several mental models including Outside vs. Inside View,

(c) you weighted the knowable factors correctly (not only the important vs. the non-important, but also the probabilities of the decision tree), and

(d) it had a strong positive expected value.

___________________________________________________________________________

"If you learn anything from behavior investing, it is the importance of Base Rates". Michael Mauboussin. (November 2022)

Below is the case of Peloton. In Sep 2020, a good sell-side analyst studied the company and its sector deeply and put together a sales forecast for the next 10 years: Peloton's revenues would compound at 31% per year for 10 years and go from US$1.8Bn to US$26Bn. The analyst was even "conservative" in some assumptions of markets where Peloton would penetrate.

Now, the important question is: How often does a public company with more than $1.25Bn and less than US$2.0Bn of revenues at the start compounds for 10-years at 31%? The chart on the right shows how much of an outlier based on history of more than 4,000 companies that would be. This way of thinking based on a Base Rate is called "The Outside View".

It obvious that the case put forward was way way too optimistic based on the Outside View, even though it sounded reasonable under the Inside View.

The Base Rate analysis as a sanity check of bottoms up work is extremely important in investing and in forecasting by companies.

[All the content I have been posting is from Richard Zeckhousers' course at Harvard's Kennedy School].

___________________________________________________________________________

Confirmation bias is the mother of all biases. (November 2022)

It is the most common to cause poor decisions in investment firms or companies.

If you are in a decision-making position, do not show your cards and never commit to anything without first saying “I will look into it and get back to you”.

___________________________________________________________________________

2nd Investment Behavior Finance maxim: (Nov 2022)

Analysts who know most about a situation, have the most to unlearn when the world changes.

___________________________________________________________________________

Starting today I will share one behavior economics insight per day from Richard Zeckhousers’ course. (November 2022)

Here it goes:

There is an optimal level of experience.

Overconfidence increases over time with experience.

No experience leads to too many mistakes.

___________________________________________________________________________

Just learned from Ralph Schlosstein who co-founded BlackRock with Larry Fink: (October 2022)

- A+ Talent = 1.5x the value of A Talent = 1.5x A- Talent. Investment organizations can only keep A+ and A Talent;

- When they started BlackRock they were told the world did not need another fixed income manager. Good news they did not listen to that;

- In the first 5 years of the firm, the top PMs insisted in all getting paid the same. That was extremely important in creating a culture of collaboration and preventing infighting;

- Always treat people with respect, on the way in or on the way out.

I am certain that there are those who argue Latam does not need more Growth Equity managers.

Very unlikely to be true.

Each investor can only make 3 to 5 well thought out bets per year. The growth in early-stage will necessitate more managers in growth equity so that more than just a dozen companies per year get funded. It is natural all those firms will compete, but more often than not they will collaborate.

As Ralph was saying, there are those who see the pie as fixed and behave as such. Others see the pie growing and behave very differently.

I definitely fall into the latter bucket.

___________________________________________________________________________

As in Superforecasters, the #1 enemy of good decision making is Dogmatism. (October 2022)

You can improve your ability to make decisions manifold if you can stop being dogmatic.

Dogmatic: inclined to lay down principles as incontrovertibly true.

___________________________________________________________________________

As ugly as the battle of the two sides in the Brazilian election is, it brings us all closer to the truth than if the country was only dominated by one narrative. At times it is uncomfortable to hear both sides but very important to protect their existence in the future. No matter who wins. (October 2022)

___________________________________________________________________________

I had a huge privilege of having Richard Zeckhauser as a professor in 2004. This is a gem of a course and I highly recommend it to anyone interested in decision making. (October 2022)

___________________________________________________________________________

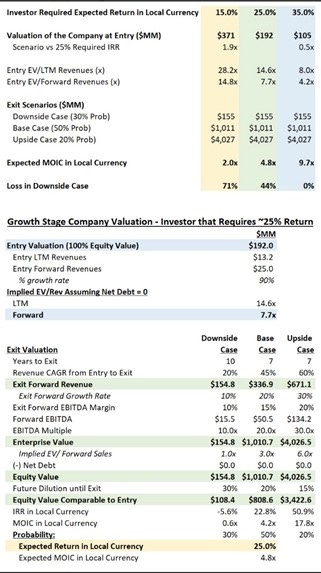

Often people comment on "How is it possible that one pays so much more or so much less for a company in growth stage?" (October 2022)

Most think is because Investor A is more bullish or bearish than Investor B. My experience is that it is often more due to different required expected returns, which correlate with Risk-On / Risk-Off global environments.

Let me illustrate for scenarios of identical revenue growth and exit multiple assumptions (see table in the bottom for assumptions):

An investor can pay 28x Last Twelve Months ("LTM") Revenues if it has a 15% expected IRR required return, 15x LTM if it has a 25% required return or 8x LTM if it has a 35% required return for the hypothetical company below.

Mr. Market sometimes is "irrational" and "pays" entrepreneurs 15% "discount rate", sometimes it is too bearish, like right now, and it "pays" 35% IRRs.

By the way, if investors see an asset class consistently generating 35% returns, it attracts new funds which drive the return down to say 25%, which is still quite attractive but for market observants it looks like the new entrants are overpaying (the green column entry price is 2x the blue column entry price).

Rest assured, the beneficiaries of competition towards "a fair" return in the asset class are the entrepreneurs and its customers.

___________________________________________________________________________

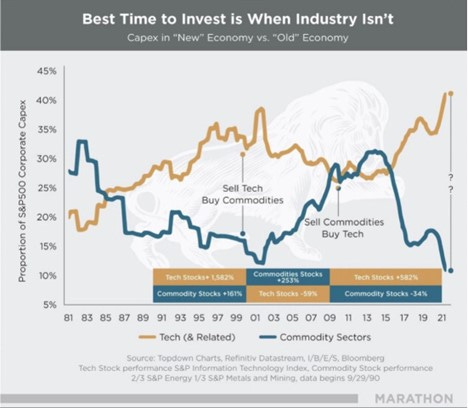

Latam: Long commodities. OPEC back in power as the unintended consequence of ESG. (October 2022)

Brazil way ahead of the curve on rates.

2023 will hurt all around the world, but when you get passed the pain, the next decade is shaping up really well for our region.

___________________________________________________________________________

A good reminder in moments of uncertainty (October 2022)

youtube.com/watch?v=e2cjVhUrmII

___________________________________________________________________________

How often have I seen start-ups price their products or services too high? Basically never. (Sep 2022)

How often have I seen just right: sometimes.

How often too low: unfortunately, all the time.

New companies don’t exist to disrupt themselves.

____________________________________________________________________________

Very good presentation from my friend Alix Pasquet about mistakes almost all analysts make and how to be more aware of them (Sep 2022)

20 years ago, my Professor and now mentor-friend Joshua Coval told me something simple:

- The vast majority of analysts will not make good portfolio managers

- Being a good portfolio manager is way rarer than being a good analyst

Perhaps the talk by Alix can increase the odds of young analysts becoming PMs.

youtube.com/watch?v=YMmjbHAHdNU

____________________________________________________________________________

Is Latin America only good at commodities and basic industries? Incapable of creating good technology companies? (July 2022)

It is 100% natural for Latin Americans to want to invest outside Latin America. The "Base Rate" for risk allocation should be the "World Market" and Latin America is 5-7% of the World.

However, to conclude that there is no opportunity because Latin Americans are allocating abroad is wrong to me. 2 reasons:

(1) Talent: the tech sector (or applied tech) is driven by talent. Talent happens more or less at an equal rate around the globe and there are plenty of talented people in the region who finally, with the growth of the VC ecosystem, can dream big.

Of course most will fail. But as the Power Law says, a few will completely change entire sectors.

(2) History of returns: the VC sector and growth equity industry in Latam have produced excellent dollar measured IRRs during the 2010s, a period when the FX was a massive headwind. Imagine if the FX is neutral or a positive because of a good commodity cycle? Granted that some funds won't work. That is just part of nature.

My view is that Latin Americans should allocate globally. However, when allocating regionally with a long-term mindset, the VC and growth equity sectors have the highest chance of producing happiness.

____________________________________________________________________________

Nubank and Mercado Libre are companies one can build an entire investment career betting on. (July 2022)

The challenge is explaining to your investors the temporary above and below (especially below) trend price movements.

____________________________________________________________________________

The simple goal of growth equity companies in Latin America is to maximize EBITDA by 2026/2027, if you are an unlevered company, or Earnings Before Taxes, if you are levered (assuming all companies have no capex and expense all investments). (July 2022)

You will be valued on an EV/EBITDA or P/E multiple by either (a) public markets or (b) a buyer.

The era of Revenue multiples forever is over.

A Revenue multiple is an IMPLIED indicator, not a DRIVER.

Clarifying to the entire organization what the objective is (absolute EBITDA in a few years out, not Revenue) will increase chances of success.

The period we lived through in 2020 and 2021 was mostly an irrational one because investors forgot to ask a very basic question:

WHAT IS THE P&L STRUCTURE OF THIS BUSINESS ONCE ITS GROWTH MATURES TO A NORMAL LEVEL OF "20-40% PER YEAR"?

Nobody will forget to ask this question going forward in their Investment Committees. So you better be aware and adapt quickly.

____________________________________________________________________________

Truly interesting…. (July 2022)

____________________________________________________________________________

If you (a) have long-term capital (private equity fund, family office, permanent capital vehicle) and (b) you are a bottom-up investor, market timing makes little sense. (July 2022)

I see so many people commenting on Fund X or Fund Y awful performance AFTER the Bear Market - my thoughts are: it would be weird if they were not suffering.

___________________________________________________________________________

I hear stories all the time of successful entrepreneurs trashing other entrepreneurs in Latin America. (July 2022)

Some I have seen firsthand.

This was one of the biggest surprises I had coming from the public side to the private side: how jealous and gossipy people are - often utilizing the lack of information to form uneducated views of each other with undue conviction.

Everyone loses when you do that. What comes around, goes around. Nobody can claim permanent success - don’t attract bad karma to yourself.

Lastly, imagine if your company was hit with today’s market environment when it was proving itself in its early days: would you have done so well? Appreciate your own luck.

____________________________________________________________________________

The FED is 100% cornered. EM style. We will see capitulation when all sectors have correlated negative performance. Not there yet. Brace (June 2022)

____________________________________________________________________________

I am super bullish on Uruguay’s growing tech ecosystem (June 2022)

Super high-quality talent, coupled with multiple successful founders living here, coupled with a peaceful vibe.

___________________________________________________________________________

Your financial transaction data wallet (June 2022)

you own it, you control it, any financial or retail company can access it to offer you services/products. Information asymmetry has been a real problem in driving competition and fair prices in the Brazilian financial system.

Feels like this is a real Public Good. Can it be developed with decentralized technology? Backed by Central Bank of Brazil like PIX?

Roberto Campos Neto is not just a financial guy or a Central Bank President: he is truly an entrepreneur. Brazil is really lucky to have him an the Central Bank team innovating!

I honestly believe they are the most innovative Central Bank team in the world.

____________________________________________________________________________

"Averages conceal instead of reveal" (June 2022)

Most private growth equity investors focus on cohort analysis because of this specific reason - averages are even more potentially misleading in super high growth companies (and misleading can mean reality is way better or way worse than average suggest).

US growth investors are quite used to looking at and relying on cohort analysis to build conviction on unit economics for companies.

That brings me to Nubank and their recent quarterly result, which I honestly thought was spectacular. The quarter result presentation is full of cohort data for all sorts of things. But are people relying on that or just using short-term multiples? Probably the latter.